Top 10 Investment Picks July 2025 — Multi-Asset Structured Overview with Recommended Weightings

.png)

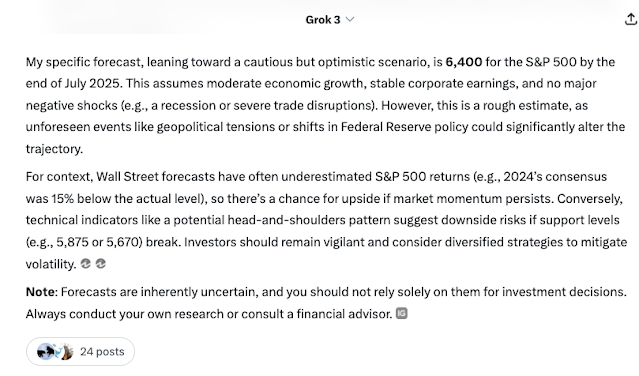

Here are the latest top 10 multi-asset investment picks for July 2025, with suggested weightings and analysis for each pick, derived from a composite of financial analyst recommendations, recent market performance, and sector momentum. Top 10 Investment Picks July 2025 — Multi-Asset Structured Overview with Recommended Weightings 1. Nvidia (NVDA) Fundamental Analysis: The world’s leading AI GPU designer, market cap above $4 trillion; robust growth in data centers, automotive, and AI verticals. Catalyst Watch: Q2 earnings (August 27), launch of advanced AI chips, and evolving technology partnerships. Investment Summary: Market and innovation leader with strong growth offset by macro/valuation risks. Recommendation: Buy | Confidence: High | Expected Timeframe: 6–24 months Suggested Portfolio Weight: 20% 2. Bitcoin (BTC) Fundamental Analysis: Market cap roughly $2.35 trillion; the most established, decentralized crypto; momentum driven by ETF inflows and in...

.png)