10 Government Grants for Small Business Malaysia

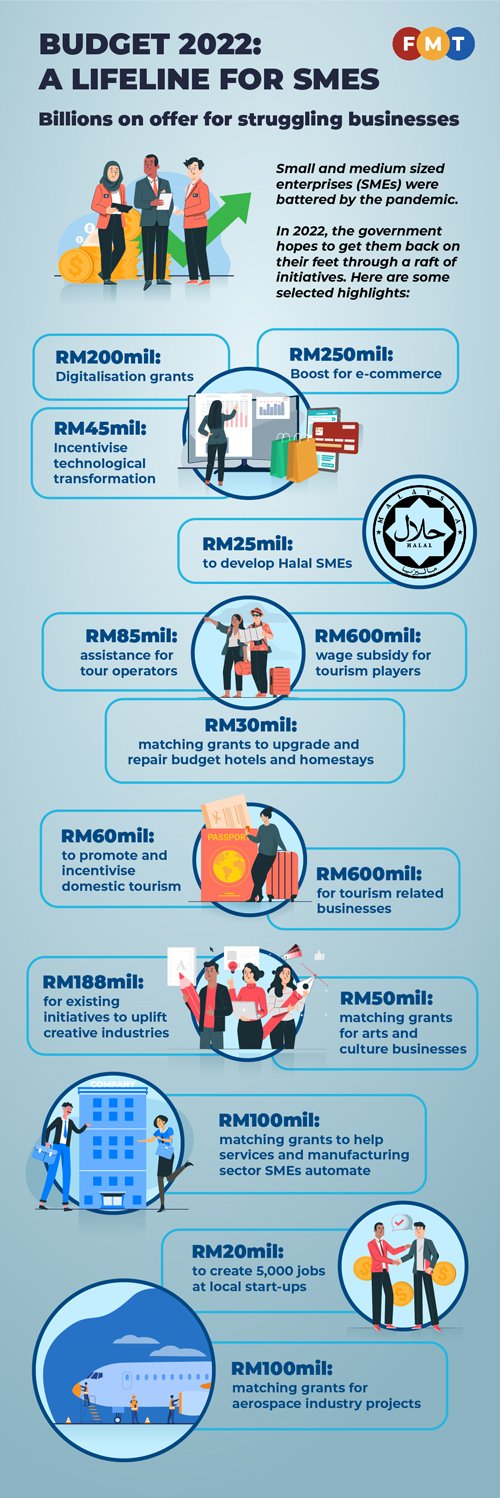

Battered and bruised by the COVID-19 pandemic, the nation’s small and medium enterprises (SMEs) have suffered from decreased sales revenue and tightened cash flow. They have faced a lack of labour and difficulties in adopting technological solutions to digitalise their business.

“They will be able to solve their cash flow problems with these grants.”

With the pandemic proving just how important it is for businesses to have an online presence, Goh said the RM200 million digitalisation grant would be especially useful as it would encourage SMEs to explore such opportunities for their businesses.

Out of the RM200 million, RM50 million has been set aside to digitalise Bumiputera micro entrepreneurs in rural areas.

Goh noted how the online shopping boom has seen platforms such as Lazada and Shopee generate massive sales over the past few years, especially during promotion periods.

According to Shopee, their 11.11 sale saw two billion items sold this year, which Goh said proved that “digitalisation is the way forward for all SMEs”.

Goh also said the e-commerce industry generated RM896.4 billion in revenue last year despite the pandemic. The figure is a 32.7% increase from the RM675.4 billion recorded in 2019.

Incentives and Financing Schemes for Businesses Under Malaysia’s Budget 2022

The budget provides several incentives, grants, and financing schemes for businesses. Several are also an extension of the benefits issued under the 2021 state budget. These include more than 19 billion ringgit (US$4.5 billion) in funding for micro, small, and medium-sized enterprises (MSMEs) and wage subsidy programs to help employers hire Malaysians. Moreover, the government has also dedicated 10 billion ringgit (US$2.4 billion) for loans dedicated to Bumiputera businesses (businesses owned by the country’s majority ethnic Malays).

New GRANTS & INCENTIVE:

1. Special Strategic Investment Fund (Grant): RM 2 Billion

A special fund for strategic investments up to RM2 billion will be prepared to attract strategic foreign investments by multinational companies, especially those that complement industry value chains and drive knowledge-based jobs creation as well as development opportunities for local SMEs.

2. Bumiputera SME Aerospace Grants: RM100 Mil

Matching grant of RM100 million will be provided to Bumiputera SMEs to explore business opportunities in the aerospace segment.

3. Green Technology Tax Incentive for Rain Harvesting

RM295 million to public universities for research and innovation as well as to encourage industry collaborations.

4. NGO’s Matching Grant

Matching grants for NGOs (RM100 m)

- Income generation and jobs creation for vulnerable groups in rural area (RM30 m)

- Tackle mental health issues through awareness programmes and capacity development (RM20 m)

- After school education and online teaching (RM20 m)

- Environmental conservation and animal welfare (RM20 m)

- Preservation of arts and heritage (RM5 m) o Social enterprise (RM5 m)

Government Grants for Small Business Malaysia 2022

1. Smart Automation Grant (SAG)

Smart Automation matching grants to 200 companies in the manufacturing and services sector to automate their business processes.

2. Industry4wrd Grants for manufacturing & service sectors (RM 45 M)

RM45 million as a technological transformation incentive for SMEs as well as mid-stage companies in the manufacturing and services sectors, in line with Industrial Revolution 4.0 or Industry4WRD.

3. R & D relevant Grants

RM423 million under MOSTI and KPT to intensify R&D activities in applying new innovations in line with the development of science and technology

4. Cradle Fund.

RM20 million for Cradle Fund Sdn Bhd’s MyStartup Strategy programme will help establish important locally developed innovations.

5. SME CORP BAP 3.0

Business Accelerator Programme (BAP 3.0) is an integrated assistance programme thatsupports a wide range of capability building initiatives to assist SMEs to grow and expand their businesses locally and globally. The grant riven is 50% up to RM400,000.

Technology Readiness Level (TRL 2-3)

Technology Development Fund 1(TeD 1) Objective is open to researchers and companies interested in implementing research and development projects (R&D) to produce new processes and products in the fields that have been identified by the Government.

With the hit of the pandemic the dynamics of the market have changed. The size of the target audience has shrunk and the customers can be found more on online portals. In such cases, the survival of offline SMEs has become scarce.

With the initiation of Boosting Online Business Grant, the Malaysian government targets to bring SMEs online. The government also wishes to promote the online transaction method in business by SMEs. With SMEs coming online, the business will receive a boost in reach of the number of customers. This will bring an increase in the net income of the business.

The grant will help all the SMEs and individuals whether they are registered as a business or not. Along with the grant, the beneficiaries receive training for onboarding e-commerce and e-payment. It also offers training for and sales support and seller subsidy.

Eligibility – E-commerce sellers, micro, small, and medium businesses, and individuals.

8. Incentivizing Women Entrepreneurs

Incentivizing Women Entrepreneurs is a government grant for self-employed females and female entrepreneurs.

Females occupy more than 40% population of the country. A lot of females wish to be entrepreneurs or are self-employed. This grant helps females financially to establish their businesses.

To promote female entrepreneurs' culture, the Malaysian government has sent RM 10 million for the program. This fund will be allocated to several eligible females. Any female entrepreneur can claim up to 70% of finical aid through this program.

Eligibility – Female entrepreneurs

9. Supporting New Startup Launches

Supporting New Startup Launches is a program launched by the Malaysian government to promote the establishment of startups.

Most startups do not have enough funds to run a high-end venture. At such a time, paying a large amount of sales tax and other taxes can become an obstacle to the growth of the company.

To help startups with the same, the Malaysian government grant launched Supporting New Startup Launches.

If a business has been launched between July 2020 and December 2021, the business can claim a tax rebate. The amount that can be saved goes as high as RM20,000 each year for three consecutive years.

Startups survive on funding. Thus under PEMERKASA, the government has extended the fundraising limits up to RM 20, million. The threshold for indebtedness has been increased to RM50,000 by SMM.

Under the same program, unregistered businesses will be able to raise funds by crowdfunding.

The program offers free business registration to students willing to launch their own startups.

Eligibility – Any business that is recently launched.

10. Sustainable Development Goals (SDGs) Financing Scheme

Sustainable Development Goals (SDGs) Financing Scheme targets to motivate businesses to join hands with the government to implement the United Nations 2030 development agenda.

United Nations has been working around the world to make life better for millions of people. In Malaysian, the government has joined hands with the UN to accomplish the United Nations 2030 agenda. The agenda involves fair and equal human rights for all in the workplace, using sustainable methods in industries, and a lot more.

To accomplish the goals, the government is calling businesses to work in the direction of meeting a minimum of one of these goals.

The agenda has 17 SDGs to follow. A company working towards any of the SDGs is eligible to claim and receive funding.

Eligibility – Any business working on at least one of the SDGs on the United Nations 2030 agenda.

.png)

.jpeg)

Comments